does massachusetts have an estate or inheritance tax

If the estate is worth less than 1000000 you dont need to file a return or. Massachusetts has no inheritance tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The good news.

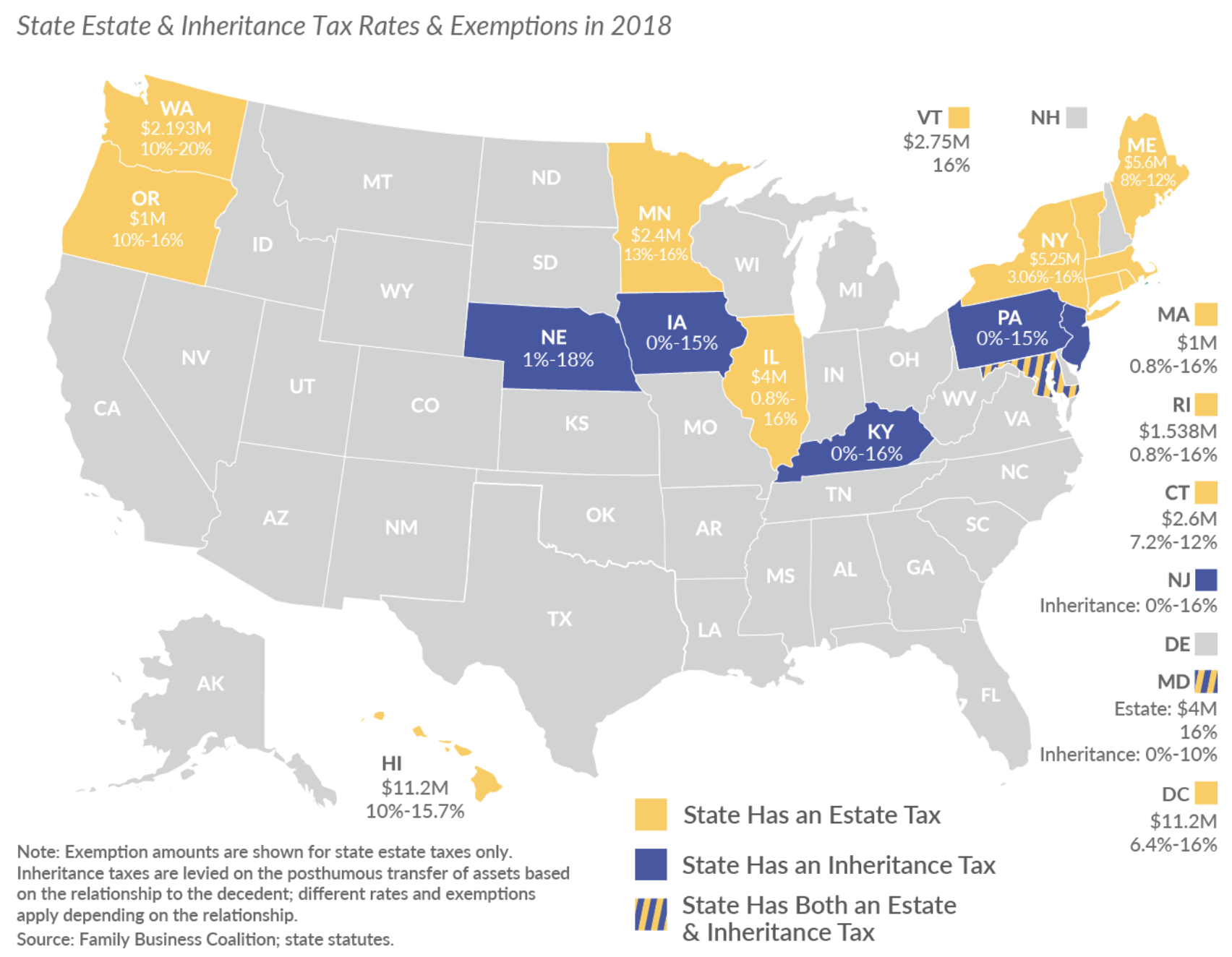

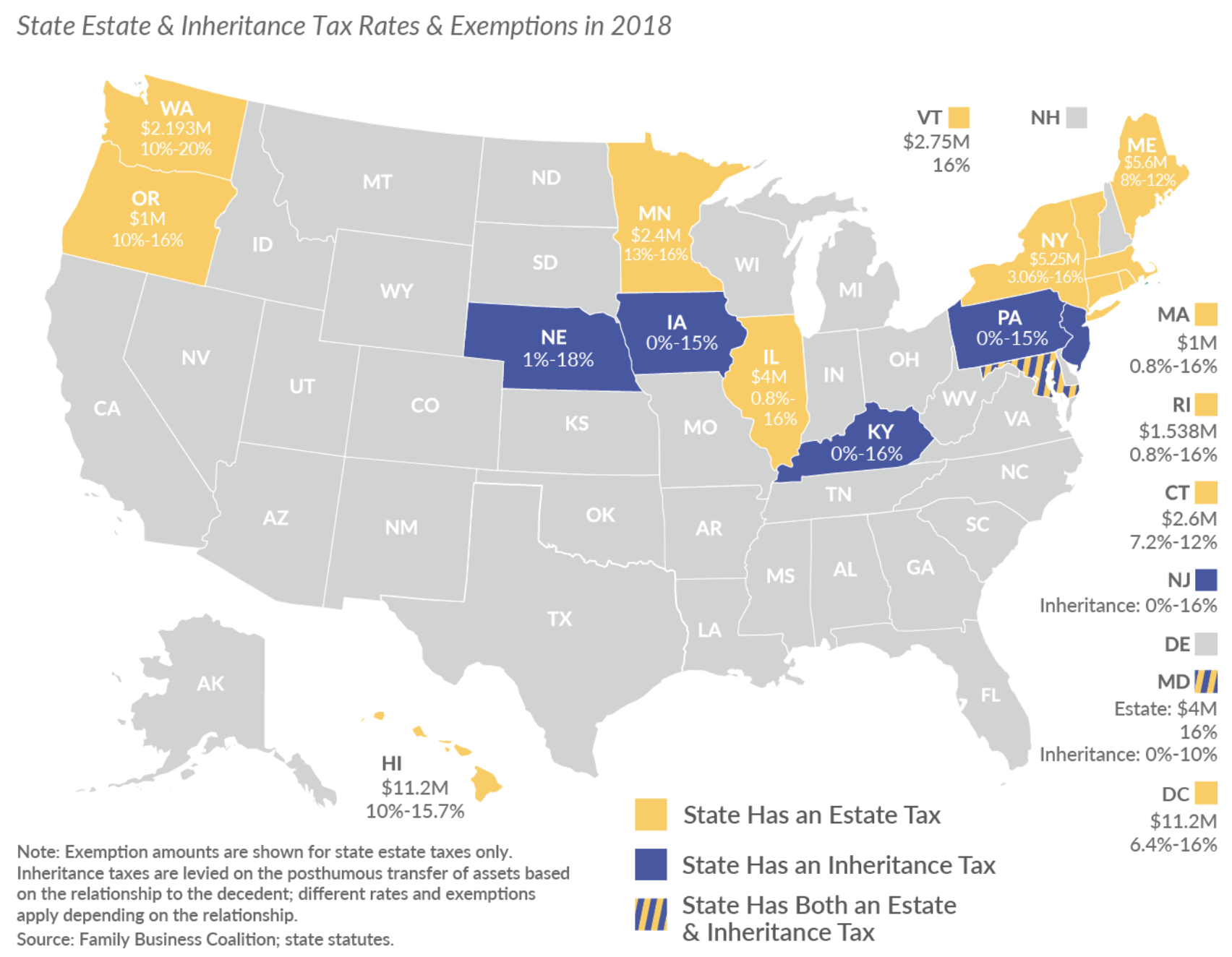

. The adjusted taxable estate used in determining the allowable credit for state death taxes in the table is the federal taxable estate total federal gross estate minus allowable federal deductions less 60000. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate taxes without the federal exemption hurt a states competitiveness. If youre a resident of Massachusetts and leave behind more than 1 million for deaths occurring in 2022 your estate might have to pay Massachusetts estate tax.

If youre inheriting money from someone who lived out of state though check the local laws. The estate tax is a tax paid by the estate of a deceased person if the taxable assets are worth more than a set threshold amount 1 million in Massachusetts. The same rule applies to nonresidents who owned property in the state.

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on December 31 2000 exceeds 1000000. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. Massachusetts has no.

If youre responsible for the estate of someone who died you may need to file an estate tax return. New Jersey finished phasing out its estate tax at the same time and now only imposes an inheritance tax. Any family estate in Massachusetts worth 1 million can benefit from estate tax planning.

If the entire estate is less than 1000000 there is no. Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue. About a third of your estate is in Massachusetts.

A family trust can have significant savings for Massachusetts couples in this example 200000. Inheritance taxes are actually something different- they are state taxes imposed on beneficiaries on the assets they receive as inheritance. Does Massachusetts Have an Inheritance Tax or Estate Tax.

Inheritance tax is a state tax paid by a beneficiary on the value of what they received as an inheritance. Fortunately Massachusetts does not levy an inheritance tax. Massachusetts has no inheritance tax.

Estate tax comes out of the deceaseds pocket. Massachusetts gives executors and. Heres how it works.

Delaware repealed its estate tax at the beginning of 2018. The terms inheritance tax and estate tax are often used interchangeably but they are very different things. This type of planning is the most common method of reducing or eliminating estate taxes.

But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax. Wife is now over the threshold by 2 million and owes a Massachusetts estate tax of around 182000. It also does not have a gift tax.

Sometimes people refer to the estate tax as inheritance tax. In Massachusetts an estate tax is generally applied to estates which exceed 1 million based on a progressive rate scale with rates starting at 08 and increasing to 16. Massachusetts doesnt have an inheritance tax.

Massachusetts does not have an inheritance tax. You should consult a tax advisor as a part of your estate planning process. A guide to estate taxes Mass Department of Revenue.

Massachusetts Inheritance and Gift Taxes. Massachusetts residents face a. The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary.

The estate tax is different from the inheritance tax which is paid by the deceased persons heirs after they receive their inheritance. Some states will levy an inheritance tax regardless of where the beneficiary or heir lives. Fortunately Massachusetts does not levy an inheritance tax.

Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. As a skilled Massachusetts estate planning attorney Matthew Karr Esq can help you tailor an estate plan to reduce or avoid Massachusetts estate tax. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax.

The Massachusetts estate tax would be about 900000 if you were a resident of the. Any Massachusetts resident who has an estate valued at more than 1 million between property and adjusted taxable gifts is required to file a Massachusetts estate tax return. The Massachusetts tax is different from the federal estate tax which is imposed only on estates worth more.

It does so proportionately. The estate tax is a transfer tax on the value of the decedents TAXABLE estate before distribution to any beneficiary. Keep in mind that even though Massachusetts doesnt have an inheritance tax it does have an estate tax.

For estates of decedents dying in 2006 or after the applicable exclusion amount is 1000000. But if you inherit money or assets from someone who lived in another state make sure you verify state law. However if youre inheriting money from someone who lived out of state you need to check the laws of that state.

Under the Massachusetts inheritance tax the holder donee of a power of appointment was not considered to have a property interest which would be taxable in. You ask a good question because Massachusetts still has an estate tax and it taxes the estates of non-residents who leave real estate in Massachusetts. The filing threshold for 2022 is 12060000.

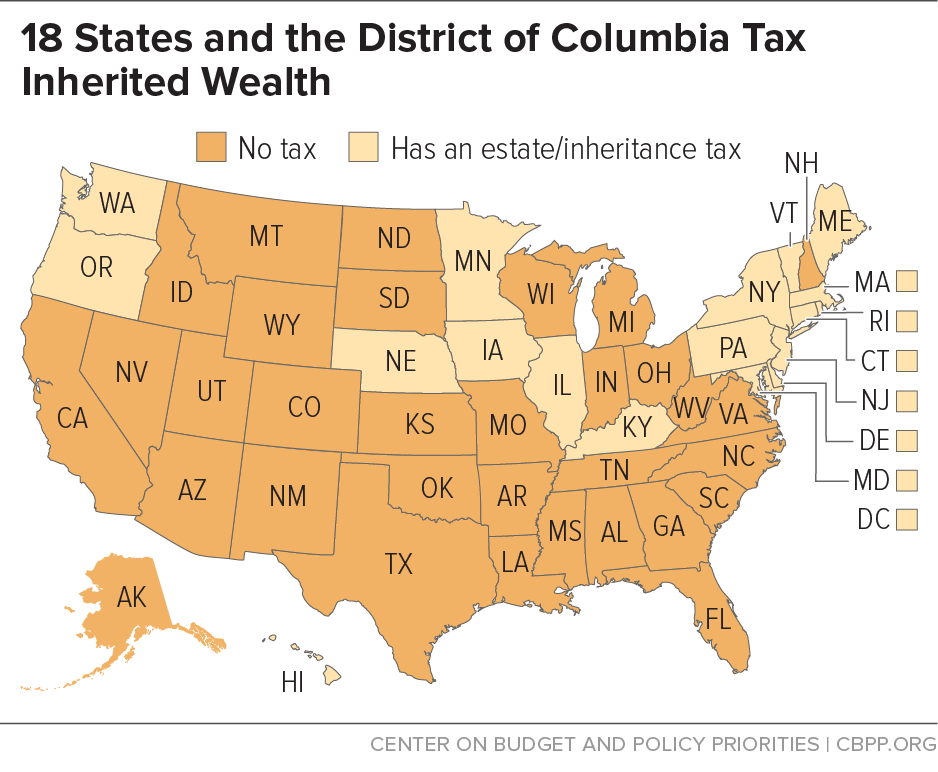

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year. Other strategies to avoid an estate tax include creating a gifting plan life insurance trusts and qualified personal residence trusts QPRTs. Massachusetts and Oregon have the lowest exemption levels at 1 million and Connecticut.

The Massachusetts estate tax is an amount equal to the federal credit for state death taxes computed using the Internal Revenue Code Code as in effect on December 31 2000. Future changes to the federal estate tax law have no impact on the Massachusetts estate tax. Call 603 230-5920 M-F 800 AM to 430 PM.

These taxes only come into play if the person who passes lives in a state that has an inheritance tax and Massachusetts does not. Massachusetts does have an estate tax but the estate is exempt from this tax unless the estate is over 1000000. The rate ranges from 8 to 16.

However while not all states have an inheritance tax the ones that do have different thresholds for how much of the inheritance has to. The main difference between estate and inheritance taxes is that the estate tax applies to the decedents assets while the inheritance tax applies to the amount the decedent leaves to their beneficiaries.

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

Massachusetts Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

What Inheritance Taxes Do I Have To Pay The Heritage Law Center Llc

What Is An Estate Tax Napkin Finance

The Estate Tax On Stocks And Dividends Intelligent Income By Simply Safe Dividends

Jfk Jr S Will Page 2 Jfk Jr Jfk Words

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A Guide To Estate Taxes Mass Gov

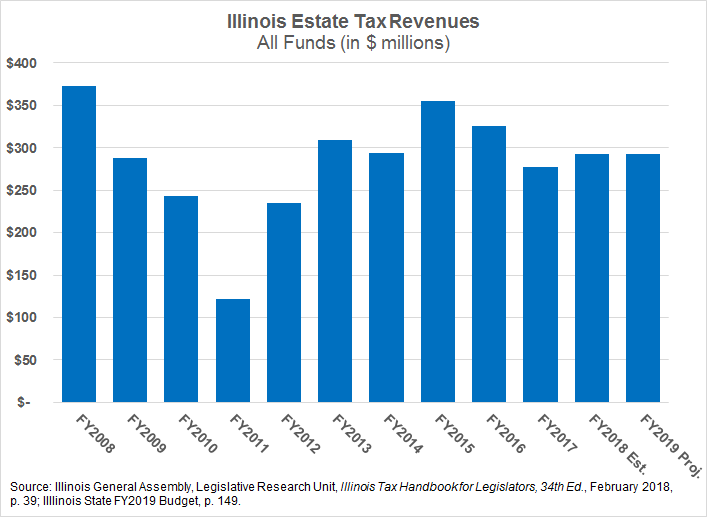

Whither The Illinois Estate Tax The Civic Federation

What Is An Estate Tax Napkin Finance

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

States Should Retain Their Estate Taxes Center On Budget And Policy Priorities

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center